federal income tax definition

Define Federal Income Tax. Income taxes are levied by the federal government and by a number of state and local governments.

Dealing With Your Federal Income Tax The Definitions Agi Adjusted Gross Income Taxable Income Or Net Income Income On Which Tax Is Computed Or One S Ppt Download

An income tax is a type of tax that is imposed on an individuals or businesss earned and unearned income.

:max_bytes(150000):strip_icc()/Marginal_Tax_Rate_Final-bcbd5163da5945a9a2389c7feb94e331.png)

. Federal income tax meaning. Taxes on income both earned salaries wages tips. Withholding Tax means the aggregate federal state and local taxes domestic or foreign required by law or regulation to be withheld with respect to any taxable event arising under the Plan.

Heres how the IRS defines income tax. Define Federal Income Tax Treatment. Notwithstanding anything herein to the contrary if the Employer reasonably.

Imposes a federal income tax on its. Federal income tax is the tax you pay on your annual income to the federal government. Stock Market Statistics Thinking about Your Financial Future Search.

In fiscal year 2021 the IRS collected more than 41 trillion in gross taxes. The federal income tax is the tax levied by the Internal Revenue Service IRS on the annual earnings of individuals. Federal income taxes are paid by individuals in proportion to their earnings after reducing the considered earnings.

A tax on workers salaries or companies profits that is paid to the US government. Federal income tax definition. What is a Federal Income Tax Definition Glossary of Investment terms.

Is amended by adding at the end thereof the following new paragraph. One set of rules. Means any Tax imposed by Subtitle A of the Code and any interest penalties additions to tax or additional amounts in respect of the foregoing.

A tax levied on net personal or business. Federal Income Taxation of Intellectual Properties and Intangible Assets by Thomas Kittle-Kamp Philip Posdewaite and David Cameron WGL 2007 is a complete reference that addresses. A tax on workers salaries or companies profits that is paid to the US government.

The federal government uses income tax revenue to support an array of services with national. The taxes that most people worry about though are federal income taxes. For example the US.

A tax levied on the annual earnings of an individual or a corporation. Generally your employer will deduct the federal income tax from your paycheck. Federal income tax synonyms Federal income tax pronunciation Federal income tax translation English dictionary definition of Federal income tax.

A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and. Federal Income Tax Liability means any liability imposed under Subtitle A of the Code and any related interest and any penalties additions to such Tax or additional amounts.

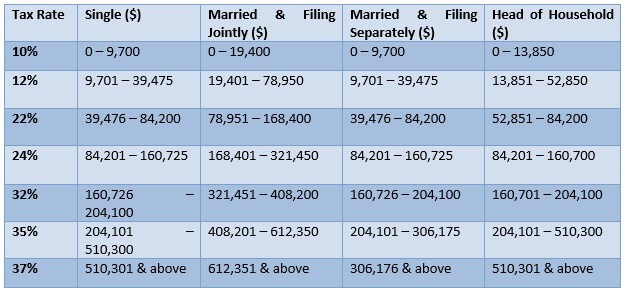

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

How Do Federal Income Tax Rates Work Tax Policy Center

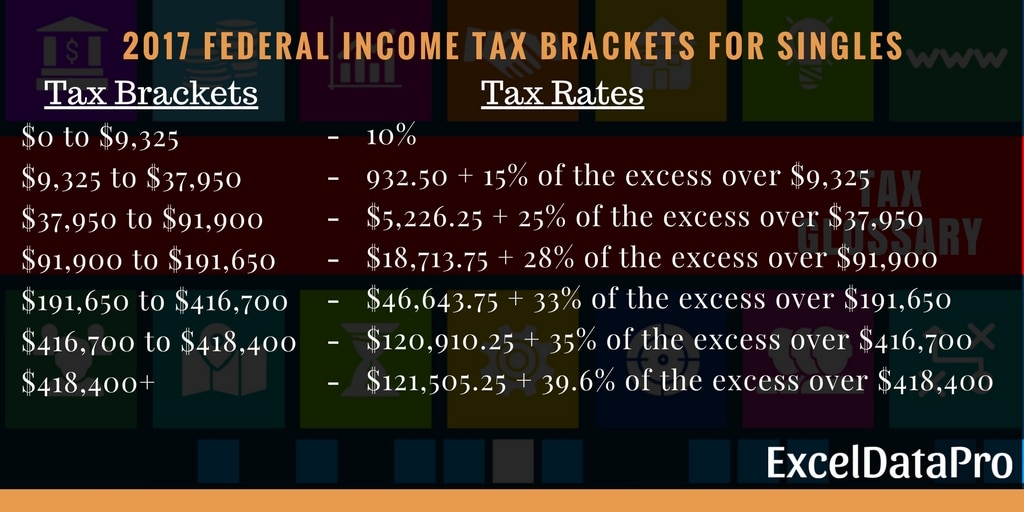

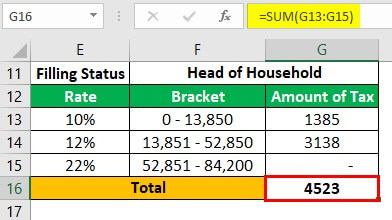

Federal Income Tax Brackets For The Year 2017 Exceldatapro

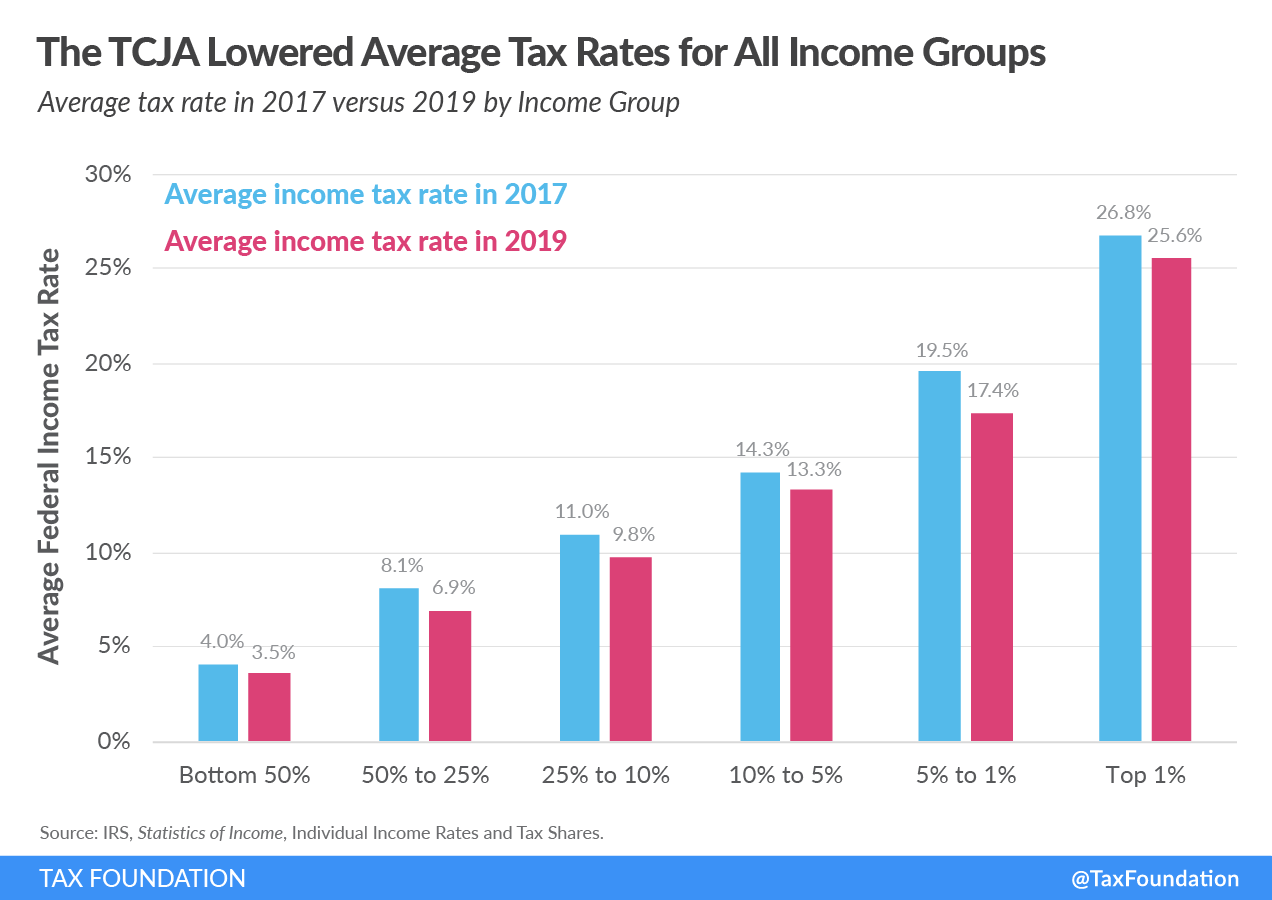

Summary Of The Latest Federal Income Tax Data Tax Foundation

:max_bytes(150000):strip_icc()/Tax_Bracket_Final-ca47afa9764b4cc4bc0b3d2237e972cb.png)

Understanding Tax Brackets With Examples And Their Pros And Cons

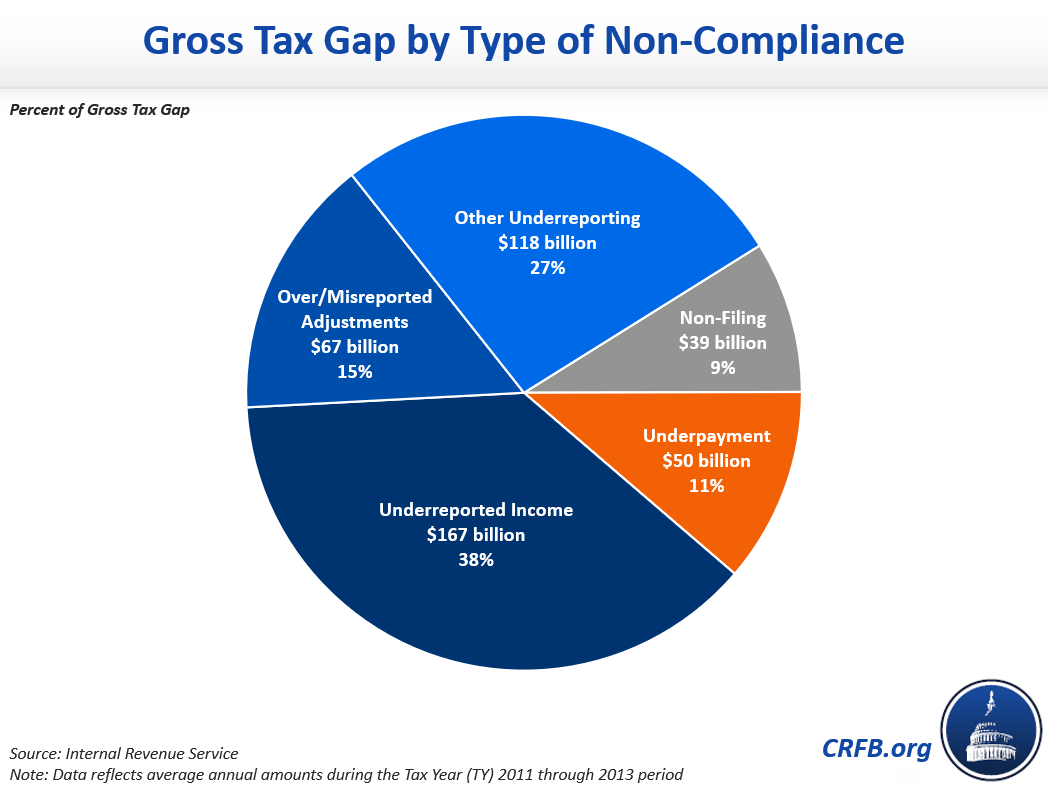

What Is The Tax Gap Tax Policy Center

Bfit Definition Before Federal Income Tax Abbreviation Finder

Federal Income Tax Definition Rates Bracket Calculation

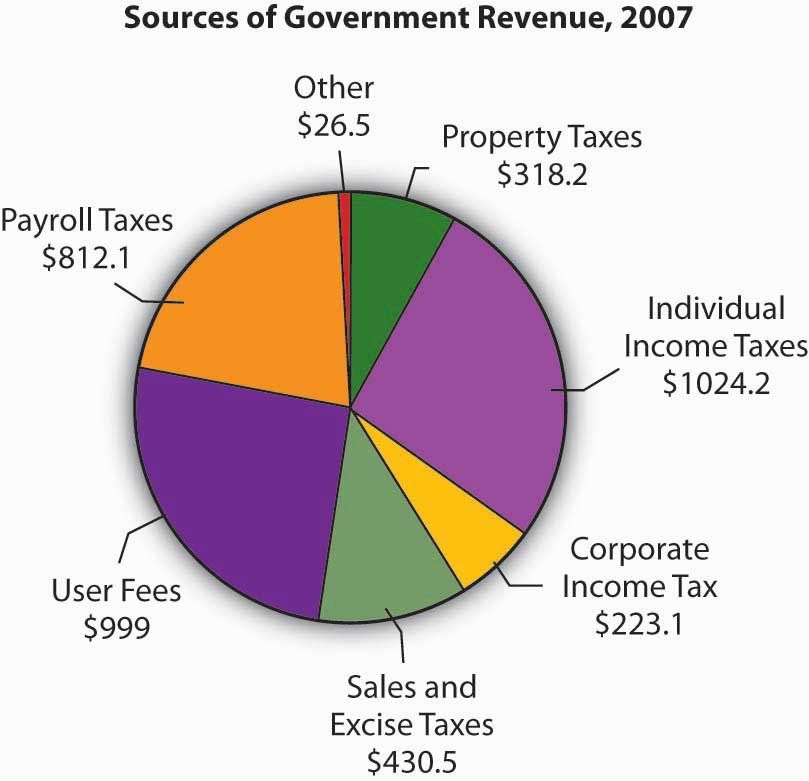

15 2 Financing Government Principles Of Economics

Summary Of The Latest Federal Income Tax Data Tax Foundation

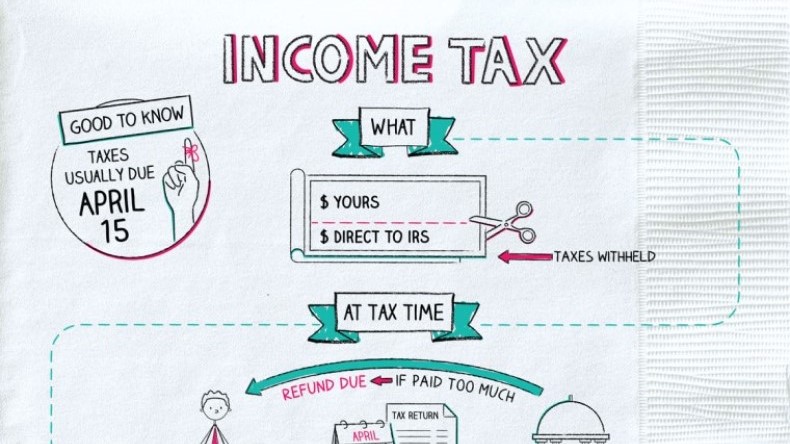

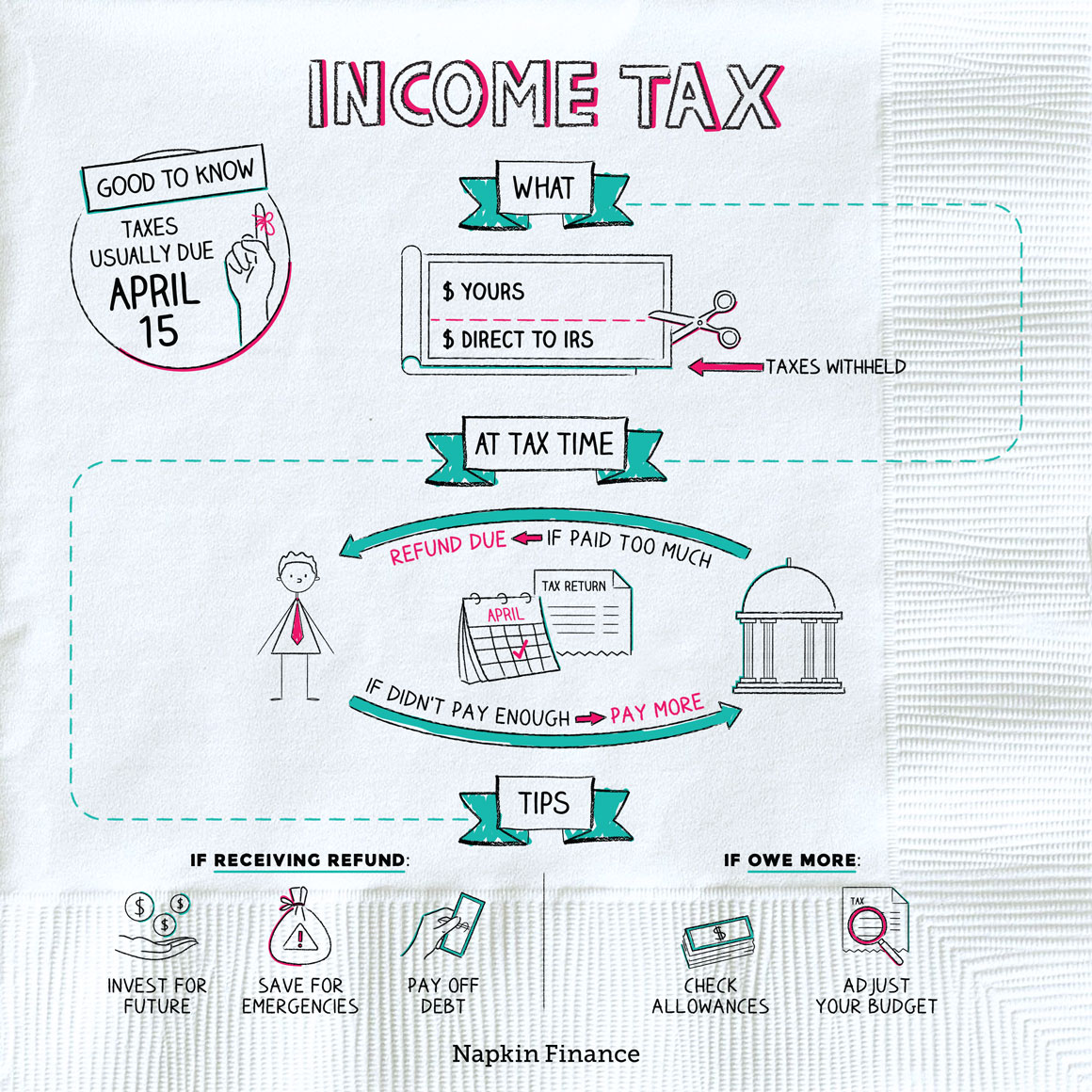

What Are Income Taxes Napkin Finance

Federal Income Tax Definition Rates Bracket Calculation

Primer Understanding The Tax Gap Committee For A Responsible Federal Budget

Research Income Taxes On Social Security Benefits

What Are Income Taxes Napkin Finance